Introduction

Hardwood lumber’s nature as a producer good piques interests in its price across the forest value chain. Secondary manufacturers are keenly aware of their raw material costs. The margin present between kiln-dried and green lumber prices can provide insights into the economics of the drying process.

The prices received by sawmillers represent the fixed and variable costs incurred to convert standing hardwood sawtimber into lumber, along with some provisions for profits and risk along each step of the process. Five year trends can provide forest landowners an understanding of the hardwood production cycle when considering a timber sale.

The prices presented in this note over the previous five years were compiled from Weekly Hardwood Review (WHR), which is distributed by Hardwood Publishing of Charlotte, NC. WHR provides market prices for a number of individual species or species groups across the eastern U.S. and Canada. Prices are provided for both green/air-dried (Gr/AD) and kiln-dried (KD) lumber for the following appearance grades- First and Seconds combined with First and Seconds 1 Face (FAS/1F), #1 Common (#1C), and #2 Common (#2C). Specifications for meeting each grade conform to National Hardwood Lumber Association rules (or slight variations).

Gr/AD prices for #3 common lumber are also listed in limited cases. Plus, prices are given for a number of non-grade hardwood products. While the quality of these non-grade products is not necessarily predicated on their appearance, some may indeed be evaluated for strength and durability. A detailed discussion of hardwood lumber pricing can be found in Luppold (1996).

North Carolina Hardwood Lumber Markets

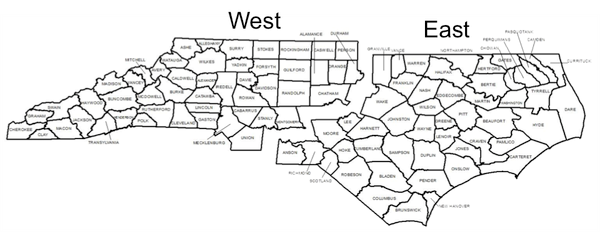

North Carolina is split into two lumber market regions by WHR. The delineation between the state’s western and eastern lumber markets closely follows the timber market regions outlined in NC State Extension Forestry’s compilation of historic timber prices (Bardon 2016a, 2016b). Western North Carolina is part of WHR’s southern Appalachian market region. Eastern North Carolina is within WHR’s Southern market region.

North Carolina Hardwood Lumber Prices

Nominal prices paid at the time for Gr/AD and KD lumber by grade are illustrated in the tables below. The prices are aggregations across a mix of key commercial species present in each region, weighted by their relative contributions to the respective region’s sawtimber inventory in 2010. They have not been adjusted for inflation. Quarterly averages (as determined by the geometric mean) were developed from WHR’s market reports. Per WHR, prices are quoted FOB mill in full truckload or carload quantities (U.S. dollars per thousand board feet, $/MBF).

Prices for western North Carolina are comprised of four groups of species- Soft (Red) Maple (Acer rubrum), Select and Non-select Red Oaks (Quercus spp.), Select and Non-select White Oaks (Quercus spp.), and Yellow-poplar (Liriodendron tulipifera). Prices for eastern North Carolina are comprised of three species groups- Select and Non-select Red Oaks, Select and Non-select White Oaks, and Yellow-poplar. An example of a select red oak in western North Carolina is northern red oak (Quercus rubra) while black oak (Quercus velutina) would be considered non-select. In eastern North Carolina cherrybark oak (Quercus pagoda) is a select species while southern red oak (Quercus falcata) is non-select. White oak (Quercus alba) is a select species in both regions.

Taken together, these steps serve three purposes. One, the proprietary nature of WHR’s market data is protected. Second, the aggregated prices can be thought of as representing a typical mix of appearance grade lumber produced by a hardwood sawmill in each region. Third, reporting lumber prices on a quarterly basis allows direct comparisons to be made with NC State Extension Forestry’s timber price reports for mixed hardwood sawtimber.

|

Year- Quarter |

FAS/1F |

#1C |

#2C |

|

2011-Q1 |

$757 |

$480 |

$369 |

|

2011-Q2 |

$777 |

$472 |

$364 |

|

2011-Q3 |

$773 |

$479 |

$362 |

|

2011-Q4 |

$766 |

$478 |

$356 |

|

2012-Q1 |

$803 |

$487 |

$355 |

|

2012-Q2 |

$853 |

$506 |

$362 |

|

2012-Q3 |

$853 |

$508 |

$373 |

|

2012-Q4 |

$875 |

$524 |

$405 |

|

2013-Q1 |

$917 |

$564 |

$443 |

|

2013-Q2 |

$959 |

$595 |

$492 |

|

2013-Q3 |

$985 |

$635 |

$507 |

|

2013-Q4 |

$1,026 |

$650 |

$532 |

|

2014-Q1 |

$1,121 |

$700 |

$550 |

|

2014-Q2 |

$1,169 |

$768 |

$565 |

|

2014-Q3 |

$1,143 |

$781 |

$560 |

|

2014-Q4 |

$1,117 |

$764 |

$550 |

|

2015-Q1 |

$1,111 |

$744 |

$526 |

|

2015-Q2 |

$1,047 |

$668 |

$457 |

|

2015-Q3 |

$988 |

$582 |

$420 |

|

2015-Q4 |

$1,013 |

$572 |

$412 |

|

Year-Quarter |

FAS/1F |

#1C |

#2C |

|

2011-Q1 |

$1,109 |

$775 |

$626 |

|

2011-Q2 |

$1,129 |

$764 |

$615 |

|

2011-Q3 |

$1,118 |

$772 |

$614 |

|

2011-Q4 |

$1,088 |

$736 |

$583 |

|

2012-Q1 |

$1,101 |

$721 |

$569 |

|

2012-Q2 |

$1,149 |

$746 |

$573 |

|

2012-Q3 |

$1,162 |

$760 |

$586 |

|

2012-Q4 |

$1,168 |

$760 |

$593 |

|

2013-Q1 |

$1,197 |

$786 |

$603 |

|

2013-Q2 |

$1,257 |

$829 |

$645 |

|

2013-Q3 |

$1,300 |

$887 |

$696 |

|

2013-Q4 |

$1,345 |

$928 |

$748 |

|

2014-Q1 |

$1,441 |

$1,012 |

$820 |

|

2014-Q2 |

$1,513 |

$1,099 |

$863 |

|

2014-Q3 |

$1,520 |

$1,133 |

$878 |

|

2014-Q4 |

$1,483 |

$1,104 |

$862 |

|

2015-Q1 |

$1,466 |

$1,059 |

$817 |

|

2015-Q2 |

$1,429 |

$983 |

$723 |

|

2015-Q3 |

$1,386 |

$881 |

$653 |

|

2015-Q4 |

$1,373 |

$835 |

$623 |

|

Year Quarter |

FAS/1F |

#1C |

#2C |

|

2011-Q1 |

$709 |

$453 |

$368 |

|

2011-Q2 |

$720 |

$458 |

$364 |

|

2011-Q3 |

$715 |

$451 |

$357 |

|

2011-Q4 |

$689 |

$436 |

$343 |

|

2012-Q1 |

$711 |

$446 |

$330 |

|

2012-Q2 |

$771 |

$475 |

$341 |

|

2012-Q3 |

$783 |

$481 |

$352 |

|

2012-Q4 |

$796 |

$502 |

$393 |

|

2013-Q1 |

$837 |

$557 |

$442 |

|

2013-Q2 |

$880 |

$586 |

$476 |

|

2013-Q3 |

$913 |

$599 |

$493 |

|

2013-Q4 |

$954 |

$628 |

$519 |

|

2014-Q1 |

$1,052 |

$698 |

$559 |

|

2014-Q2 |

$1,101 |

$733 |

$570 |

|

2014-Q3 |

$1,079 |

$735 |

$566 |

|

2014-Q4 |

$1,045 |

$712 |

$550 |

|

2015-Q1 |

$1,039 |

$683 |

$523 |

|

2015-Q2 |

$989 |

$602 |

$454 |

|

2015-Q3 |

$934 |

$527 |

$420 |

|

2015-Q4 |

$950 |

$536 |

$421 |

|

Year Quarter |

FAS/1F |

#1C |

#2C |

|

2011-Q1 |

$1,001 |

$696 |

$598 |

|

2011-Q2 |

$1,022 |

$699 |

$596 |

|

2011-Q3 |

$987 |

$694 |

$571 |

|

2011-Q4 |

$950 |

$655 |

$527 |

|

2012-Q1 |

$969 |

$656 |

$526 |

|

2012-Q2 |

$1,035 |

$683 |

$549 |

|

2012-Q3 |

$1,043 |

$693 |

$558 |

|

2012-Q4 |

$1,061 |

$698 |

$567 |

|

2013-Q1 |

$1,111 |

$740 |

$608 |

|

2013-Q2 |

$1,192 |

$817 |

$662 |

|

2013-Q3 |

$1,243 |

$858 |

$706 |

|

2013-Q4 |

$1,283 |

$919 |

$771 |

|

2014-Q1 |

$1,379 |

$1,019 |

$863 |

|

2014-Q2 |

$1,467 |

$1,110 |

$896 |

|

2014-Q3 |

$1,469 |

$1,108 |

$898 |

|

2014-Q4 |

$1,422 |

$1,058 |

$857 |

|

2015-Q1 |

$1,404 |

$1,002 |

$767 |

|

2015-Q2 |

$1,366 |

$900 |

$684 |

|

2015-Q3 |

$1,303 |

$802 |

$622 |

|

2015-Q4 |

$1,272 |

$788 |

$603 |

References

Bardon, R. 2016a. Historic North Carolina timber stumpage prices, 1976-2015. N.C. Cooperative Extension note.

Bardon, R. 2016b. Historic North Carolina delivered timber prices, 1988-2015. N.C. Cooperative Extension note.

Luppold, W. 1996. An explanation of hardwood lumber pricing. Forest Products Journal 46(5):52-55.

Weekly Hardwood Review. 2011 to 2015. Weekly market reports. Hardwood Publishing, Charlotte, NC.

Publication date: March 28, 2016

N.C. Cooperative Extension prohibits discrimination and harassment regardless of age, color, disability, family and marital status, gender identity, national origin, political beliefs, race, religion, sex (including pregnancy), sexual orientation and veteran status.