On May 28, 2009, new rules for reporting of lump-sum timber sales went into effect. TD 9450 approved for release by IRS’s Office of Chief Counsel on May 15, 2009, outlines the changes to Treasury Regulations §1.6045-4. This section is amended to require purchasers of standing timber in a lump-sum transaction to report the sale or exchange of the timber to the IRS using IRS Form 1099-S (Proceeds from Real Estate Transactions) and to provide the completed form to the seller.

The Internal Revenue Code (IRC) section 6045(e)(2) now requires the issuance of this informational form to timber sellers due to the amendment of paragraphs (b)(2)(i)(E), (b)(2)(ii) and (c) (2)(i) of the treasury regulation section 1.6045-4 for sales of exchanges of standing timber for lump-sum payments completed after May 28, 2009. The Form 1099-S is to be provided to the seller by January 31 of the year following the sale and to IRS.

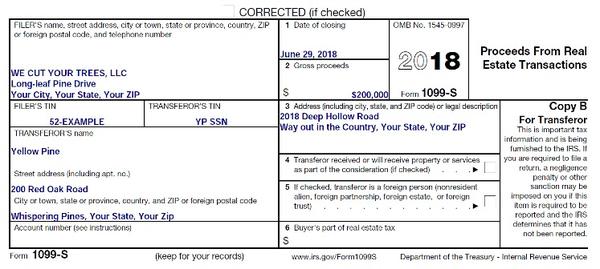

Example: Yellow Pine owns 50 acres of pine timber that is mature and ready for harvest. Yellow hires a consulting forester to cruise and conduct a lump-sum sale by sealed bidding of the 50 acres of timber land. The buyer, We Cut Your Trees, LLC bid $200,000 for the timber. The closing date (timber deed executed and delivered) occurs on June 29, 2018, and a check for $200,000 is delivered to the seller on the same date. The successful buyer must now issue an IRS Form 1099-S to Yellow Pine by January 31, 2019 (see example below). In Box 1 the date of June 29, 2009, is placed and in Box 2 the amount of $200,000 is found. Relevant details for Filer and Transferor are placed in the appropriate boxes. The description of the timber is found in Box 3.

These final regulations do not change the information reporting requirements currently applicable to sales or exchanges of standing timber under pay-as-cut or contingent payment arrangements as found in IRC § 6050N.

Publication date: June 1, 2009

N.C. Cooperative Extension prohibits discrimination and harassment regardless of age, color, disability, family and marital status, gender identity, national origin, political beliefs, race, religion, sex (including pregnancy), sexual orientation and veteran status.