Introduction

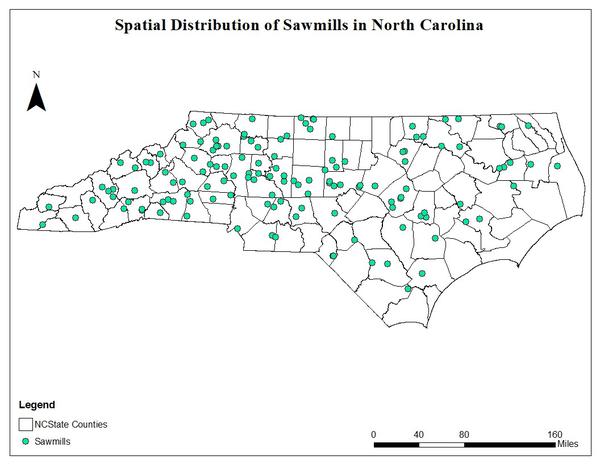

Similar to the logging industry, the primary sawmill industry is a vital component of the forest products supply chain in North Carolina. A number of sawmills are located throughout the state processing roundwood sawlogs to produce lumber (Figure 1). Sawlog is the main industrial roundwood harvested in North Carolina, representing about 43% of the total industrial roundwood production in 2017 (USDA Forest Service, 2020). North Carolina produces about 2.3 billion board feet (BBF) of lumber annually, about 700 million board feet more than the annual lumber consumption in the state, implying that North Carolina is a net lumber exporter (Parajuli and McConnell, 2019). In 2018, the North Carolina primary solidwood industry contributed about $4.5 billion to the state economy, supporting more than 17,000 jobs in North Carolina (Parajuli and Bardon, 2020). This article examines the historical trends of the sawmill industry in North Carolina in terms of the number of companies, employment, and economic contribution to the state economy.

Historical Trends of the North Carolina Sawmill Industry

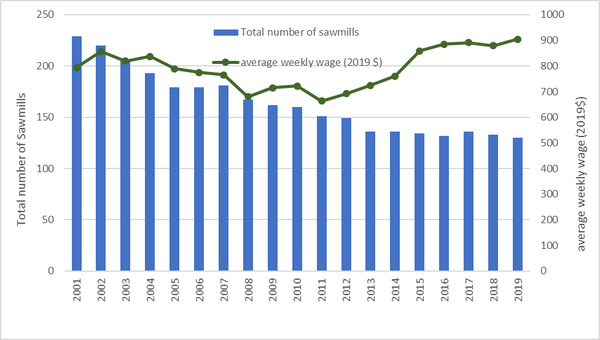

Figure 2 depicts the historical trends of the annual size of the sawmill industry and the average weekly wage of sawmill employees in North Carolina. According to data reported by the Quarterly Census of Employment and Wages of the US Bureau of Labor Statistics, the North Carolina sawmill industry has lost over 100 independent companies over the last two decades, due to a combinations of closures, mergers and other factors. In 2001, there were 229 sawmill companies in North Carolina, but the number dropped to below 140 in 2013, and remained stable around lower 130s in the recent years (QCEW, 2020).

Figure 2 also presents the average weekly pay (inflation-adjusted) of sawmill employees in North Carolina. As indicated by the green line, the average weekly wage has trended upward since 2011. It has increased considerably since the 2008-09 great recession. In 2019, the weekly pay was $905 on average, which was about 36% higher than the 2011 wage level. One of the reasons behind the pay increment could be the decreasing number of companies which leads to lower competition.

Annual Sawlog Production and Timber Prices in North Carolina

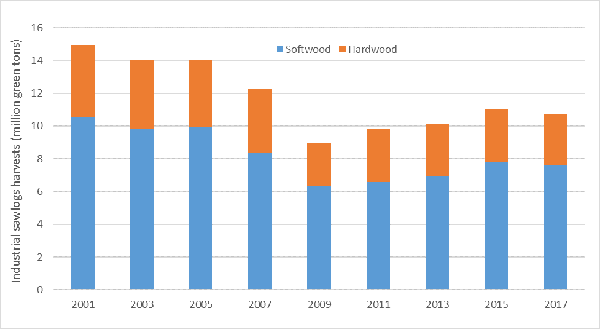

The quantity of sawlog harvests also highlights the importance of the sawmill industry in the forest product supply chain. The bi-annual timber products output (TPO) survey conducted by the US Forest Service and the North Carolina Forest Service revealed that the annual industrial sawlog harvests, including both softwood and hardwood species, declined from about 15 million green tons in 2001 to approximately 11 million green tons in 2017 (Figure 3). The lowest level of the sawlog production in North Carolina was 9 million green tons in 2011. In the last few years, it remains stable around 10 million green tons annually. Note that the sawlog receipts (total sawlog consumed) by North Carolina sawmills are even higher, indicating that along with the sawlog harvests within the state, North Carolina sawmills import sawlog from neighboring states.

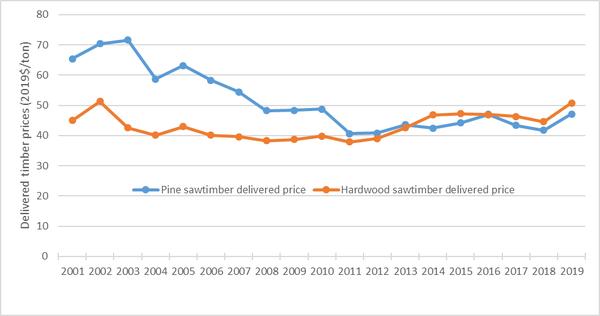

Figure 4 presents the historical delivered prices (inflation-adjusted) of pine and hardwood sawtimber, the prices paid for sawlogs by sawmills at the gate. According to the TimberMart-South data, while hardwood sawtimber delivered prices in North Carolina have remained flat or even trended upward in recent years, pine sawtimber delivered prices have dropped substantially. In 2002, sawmills paid about $70/ton for pine sawtimber, which was down 33% to about $47/ton in 2019 (TMS, 2020). Prior to 2008, the delivered price for pine sawtimber was about $20/ton higher than the price for hardwood sawtimber, but since 2013, the average hardwood sawtimber price has surpassed the pine sawtimber delivered price in North Carolina. Even though the housing markets, the main user of dimension lumber, have improved significantly in recent years, the oversupply situation of pine sawtimber is reportedly the primary reason behind the declining pine sawtimber prices in recent years.

Economic Contribution of the North Carolina Primary Sawmill Industry

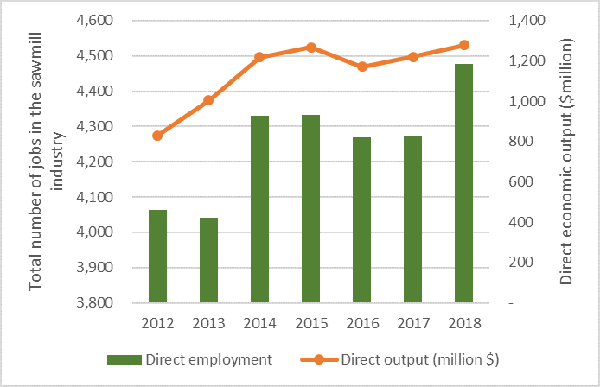

Figure 5 depicts the annual economic contribution of the North Carolina sawmill industry to the state economy. In 2018, the direct employment, including full-time, part-time and seasonal jobs, supported by the sawmill industry in North Carolina was about 4,500, about 11% higher from 2013 (IMPLAN, 2020). Similarly, all the economic activities within the sawmill industry, termed as direct economic output, generated by the North Carolina sawmill industry were monetized around $1.2 billion every year. Please note that these economic contribution numbers are just within the sawmill industry. If we account for the ripple effects created by sawmills in the rest of the economy, these numbers would be higher. For the detailed economic contribution analysis of the forest section by industries, refer to Parajuli and Bardon (2018).

Conclusion

The long-term historical trends suggest that the North Carolina sawmill industry has been a significant industry of the North Carolina forest sector over the years. While the number of sawmill companies has declined over the years, the weekly wage of employees in the sawmill industry continued to move upward since 2011. Similarly, sawmills in North Carolina consume over 12 million green tons of roundwood sawtimber annually, which was primarily harvested in North Carolina. The delivered timber prices for pine sawtimber declined significantly in the recent years, due primarily to the oversupply condition of sawtimber in the market. Despite the declining number of sawmill companies, direct jobs supported by the primary sawmill industry in North Carolina have trended upward in the last few years.

References

- IMPLAN. 2020. Economic Impact Analysis for Planning. Huntersville, NC.

- Parajuli, R., and E. McConnell. 2019. North Carolina Lumber Production, Consumption, and Revenue Trends, 1998 to 2016.

- Parajuli, R., and R.E. Bardon. 2020. Economic Contribution of the Forest Sector, 2018.

- QCEW. 2020. Quarterly Census of Employment and Wages. Statewide logging NAICS 1133 database.

- TMS. 2020. Quarterly timber prices. Timber Mart South, Athens, GA.

- USDA Forest Service. 2020. Timber Product Output and Use for All, 2017. Resource Update FS-. Asheville, NC: U.S. Department of Agriculture, Forest Service, 2 p.

Publication date: Sept. 14, 2020

N.C. Cooperative Extension prohibits discrimination and harassment regardless of age, color, disability, family and marital status, gender identity, national origin, political beliefs, race, religion, sex (including pregnancy), sexual orientation and veteran status.