Historically, reforestation has been a strong long-term investment for landowners. This publication assesses the pine reforestation investment based on current stumpage prices and associated costs to determine whether it still offers attractive returns. We review potential returns from typical pine plantations in the U.S. South. Southern pine reforestation can be an excellent long-term investment even under conservative management assumptions.

Many landowners regularly invest in other long-term investments such as individual retirement accounts (IRAs), stocks, and bonds but forego the likely chance to earn high returns from timber production. Tax incentives, cost sharing programs, and increased property value are added benefits of reforestation. In this note, we compare potential economic returns from a range of forestry investment options to make informed forest investment decisions.

Like all markets, timber and wood product stumpage prices ebb and flow. Our analysis suggests that a forest landowner can ensure that costs are kept in line with expected returns in any stage of the business cycle. By studying the "numbers" and understanding planting costs and expected returns, a savvy landowner can make appropriate reforestation decisions to ensure profitability at any investment level.

Information Needed to Analyze a Reforestation Investment

To analyze the potential benefits of reforesting, you will need four pieces of information:

- Costs of stand establishment (costs of site preparation, reforestation, and silvicultural practices). Reforestation costs depend on site conditions and the owner’s investment objectives. With well-drained soil on a site that is relatively free of competing vegetation, little additional preparation may be necessary. However, even old field sites can have fierce competition that may initially be hidden until the next growing season. Site preparation costs increase as competing vegetation increases and will be largest on wet, poorly drained sites requiring draining, ditching, and bedding. Periodic applications of fertilizers after planting, mid-rotation, and after thinning are also cost-intensive practices.

Costs of stand establishment could range widely from less than $100 (seedlings and planting costs) to more than $450 per acre. Natural seeding can restock your woods with seedlings of a desirable tree species at little or no cost. However, managing over-stocked natural stands can equal or exceed the costs of site preparation and planting in the long-run, and there is no control in selecting improved tree genetics (McKeand, 2017). - Intensity of ongoing management activities. Landowners may incur management costs such as prescribed burning, boundary line maintenance, fire line construction and maintenance, and insect or disease protection. Annual property taxes are also recurring expenses. These costs typically will not exceed $2 to $4 per acre per year.

- Future revenue streams from thinning(s) and final harvest. Species- and location-specific growth and yield models are used to project timber growth. Such growth and yield models primarily depend on site productivity of the land, the number of trees per acre planted, frequency and intensity of thinnings, the rotation length, fertilization, or other silvicultural activities.

A forester measures the potential productivity of the land using the concept of "Site Index" (SI). SI is the total height to which dominant trees will reach on a given site by a certain age, usually 25 years, on pine plantations. For example, if the site index for a particular site is 70 at 25 years for loblolly pine, foresters expect loblolly seedlings planted on that site today to be 70 feet tall in 25 years. For additional information on site index, see Woodland Owner Note 7, Forest Soils and Site Index.

Several growth and yield embedded investment calculators (web-based applications) for forestry investment and analysis are available for free as well as for purchase. See Woodland Owner Note-63, Valuing Immature Forest Stands.

Once the future timber yields are obtained from a growth and yield model, total timber values can be obtained by multiplying timber volume by the stumpage price. This publication assumes no timber price increases because it is hard to predict future stumpage prices. Assuming no price increase keeps the reforestation to be made strictly on real returns at the time of the investment—the assumption being that any future stumpage increases will only enhance returns. This publication also assumes that inflation will match any price increases, which vastly simplifies the analysis. - Interest rate or discount rate. The interest rate is an important determinant in any financial analysis. It represents the cost of capital or the interest payment you need to make for your mortgage. It also captures the opportunity costs of the investment, which implies that a benefit could have been received but was given up to obtain another course of action.

Analyzing Reforestation Investments

Three various levels of reforestation investments in terms of initial stand establishment costs are assumed to illustrate the range of likely financial returns available to North Carolina landowners.

Several financial criteria are used to evaluate reforestation investments and interpret their profitability.

Net Present Value (NPV) is the net benefit (in today’s dollar value) from any investment after accounting for all the costs and potential revenues. NPV represents the value of expected future returns minus the value of expected future costs all in today’s dollars. Investments with a positive NPV yield a higher return than the interest rate used to discount the investment to the present day. To select the optimal investment, choose the one with the highest NPV to maximize returns (all other assumptions held constant).

Net Annual Equivalent (NAE) converts NPV to an equal annual amount over the life of the investment. Since forestry investments are long term, it’s often preferable to have an “annual” or rent-like figure to compare investments on an annual scale.

Return on Investment (ROI) is the maximum net return you can obtain from the investment after covering all costs. ROI is the “true” compound interest rate that equates the present value of future incomes with the present value of future costs. An investment is acceptable if the ROI equals or exceeds the minimum acceptable rate of return (i.e., the interest rate used in the analysis). In choosing between two investments, the investment with the higher ROI is preferred. ROI is often termed the “internal rate of return (IRR).”

Assumptions for investment analyses:

1. All incomes are pre-tax. The prevailing 2019 stumpage prices of $25 per ton of pine sawtimber, $17 per ton of chip-n-saw, and $12 per ton of pine pulpwood are assumed. All prices are assumed to remain constant for the length of the rotation (crop cycle).

2. After-tax management costs are $2 per acre per year.

3. The rotation age for loblolly pine is 30 years, assuming 436 trees per acre (spaced 10 feet by 10 feet) initially with up to two thinnings.

4. Both LobDss Pine and PTAEDA 4.0 were used to generate product-specific growth data from thinning(s) and final harvest. LobDss Pine requires a membership to the Forest Productivity Cooperative for use. PTEADA 4.0 is available for purchase through the Virginia Tech Forest Modeling Research Cooperative Program.

5. To calculate net present value (NPV) and net annual equivalent (NAE), future incomes and periodic costs are discounted to the present at a five percent annual rate (real rate of return).

Investment Analysis

To assess the value of forestry investments, we compare returns to alternative investment opportunities. Returns will vary with soil quality, length of growing period, investment and management strategies, market competition, tax bracket, and tree species. The examples given here assume zero inflation and growth of pine stumpage pricing (or a convenient offset of future fluctuations by either measure). Curious investors might add nominal rates of return (including inflation) to approximate the inflation rate to the “real rates of return” presented here.

Example 1. Low Investment Option: $100 per acre of total site preparation and reforestation costs. This example covers only the costs of seedlings and planting. About 30% of total basal area in hardwoods at crown closure is assumed with no competing vegetation control. Greater competition would result in lower forest productivity.

|

Site Quality |

Net Present Value (NPV) |

Net Annual Equivalent (NAE) |

% Return on Investment (ROI) |

|

Low (SI 55) |

$249.3 |

$16.2 |

9.4 |

|

Medium (SI 65) |

$336.5 |

$21.9 |

10.3 |

|

High (SI 75) |

$433.3 |

$28.2 |

11.2 |

Example 2. Medium Investment Option: $250 per acre of total site preparation and reforestation costs. Along with the costs of seedlings and planting, this example covers chemical site preparation for hardwood control. About 15% of total basal area in hardwoods at crown closure is anticipated.

|

Site Quality |

Net Present Value (NPV) |

Net Annual Equivalent (NAE) |

% Return on Investment (ROI) |

|

Low (SI 55) |

$281.5 |

$18.3 |

7.9% |

|

Medium (SI 65) |

$409.3 |

$26.6 |

8.8% |

|

High (SI 75) |

$544.3 |

$35.4 |

9.8% |

Example 3. High Investment Option: $450 per acre of total site preparation and reforestation costs. Along with the costs of seedlings and planting, this example covers chemical site preparation for hardwood control, bedding, and herbaceous weed control at Year 1 (for a poorly drained site; a well-drained site would not need bedding). Fertilizers of 200 lb/acre of elemental nitrogen and 25 lb/ac elemental phosphorous at Year 8 and after first thinning are applied. No hardwood at crown closure is anticipated.

|

Site Quality |

Net Present Value (NPV) |

Net Annual Equivalent (NAE) |

% Return on Investment (ROI) |

|

Low (SI 55) |

$437.4 |

$28.5 |

8.1% |

|

Medium (SI 65) |

$630.4 |

$41.0 |

9.2% |

|

High (SI 75) |

$845.9 |

$55.0 |

10.4% |

Summary

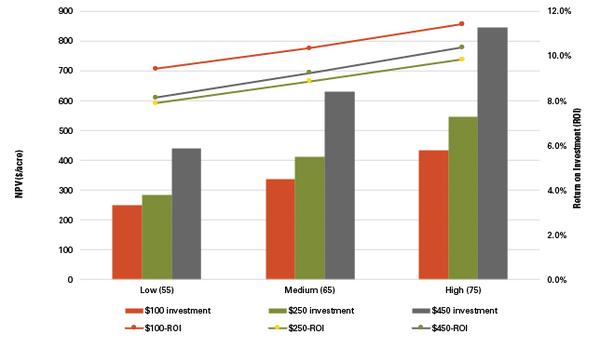

Three examples of various levels of initial investment in reforestation reveal that southern pine reforestation can still be an excellent long-term investment even under the current lower sawtimber price and conservative management assumptions. The analysis suggests that the higher productive land always offers higher returns. While net dollar return is highest with the highest cost options, the best return on investment (ROI) comes with the lower initial level of investment in the higher productive site (Figure 1). The ROI of about 9 to 11% is highly competitive among other investment opportunities. For instance, in the last 30-year period (1993 to 2023), the stock market (S&P 500) offered an annual average of 9.9% real returns, and the 10-year Treasury bond yielded nearly 4.3% annually.

A prudent investor weighs alternatives and chooses the option that matches their return, risk, and available resources. In making investments, be sure to weigh the merits of foregone consumption versus the potential for generating greater future returns. Always remember; the present value of estimated future returns must exceed investment costs.

Risks associated with forestry investments include damage from insects, diseases, wildfires, extreme weather, and cyclical markets. Proper and diverse timber management strategies can reduce some of these risks by fostering vigorous timber stands. Forest landowners should consider soil quality, tree species, local markets, costs, anticipated yields, and professional advice before investing in reforestation or timber stand management.

While there is much uncertainty about future costs, prices, and tree growth, the economic analysis provides an unbiased assessment of investment potential. These financial numbers are based on several assumptions on costs, growth projections, and future revenue streams. New improvements in genetics that improve growth rates may not be captured by the growth and yield model we employed in this analysis. Rising levels of atmospheric CO2 may increase site index, causing faster tree growth (Westfall and Amateis, 2003). Similarly, future market changes, pricing, and technology improvements on the production side, as well as risk factors, may negate or reduce these projections. Current pulpwood prices are much closer to sawtimber prices than at any time in recent history (sawtimber prices are about two times that of pulpwood prices). Twenty years ago, sawtimber was five times the price of pulpwood, and just 10 years ago sawtimber was three times the price of pulpwood. Should sawtimber prices once again rise significantly relative to pulpwood prices, longer rotations with changes in planted trees per acre and larger forestry investments will become more attractive. With the assumption of the 2019, 2-to-1 price differential continuing in the future, large forestry investments will need to be confined to shorter rotations of 30 years or less. Current, 2024 prices show a 3-1 differential that has only a small change in return on investment from the 2019 assumptions. Local prices can impact decision making. This gives one example of the potential for returns on timberland. Consult professionals before making a specific decision about your timberland investment.

For more information and help in evaluating a particular timber investment opportunity, contact your local Cooperative Extension center, NC Forest Service Office, or a professional forester.

References

McKeand, S. 2017. Making sense of the genetics market. Forest Landowner Magazine, September/October. Forest Landowners Association. 14-17.

Westfall, J.A., and R.L. Amateis. 2003. A model to account for potential correlations between growth of loblolly pine and changing ambient carbon dioxide concentrations. Southern Journal of Applied Forestry 27(4): 279-284.

Publication date: May 23, 2019

Reviewed/Revised: July 9, 2024

WON-08

N.C. Cooperative Extension prohibits discrimination and harassment regardless of age, color, disability, family and marital status, gender identity, national origin, political beliefs, race, religion, sex (including pregnancy), sexual orientation and veteran status.